4 401k match calculator

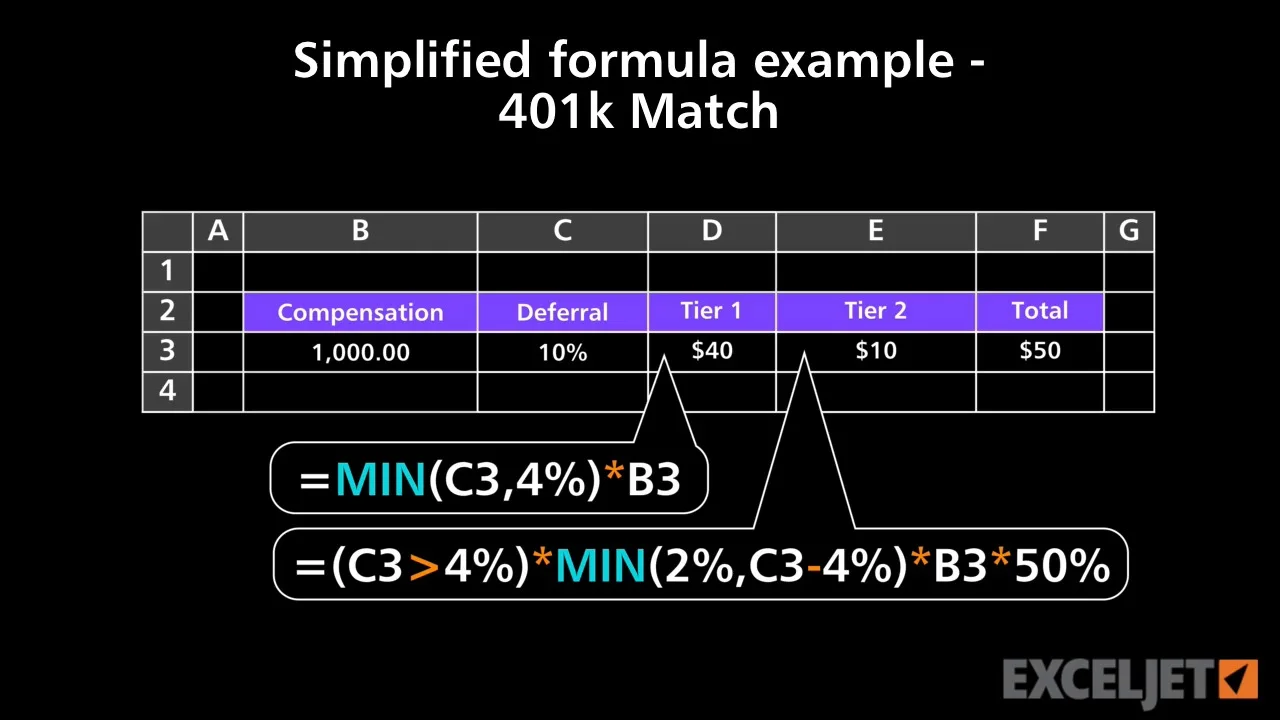

If you dont have data ready. If the employee wants to withhold more than 4 percent of gross wages the benefit will match 50 percent up to 4 percent of the gross wages.

Explainer How Does Employer 401 K Matching Work Ellevest

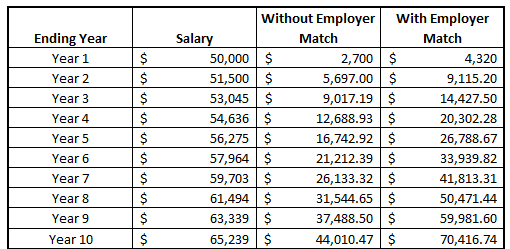

Stillthats 6000 extra dollars into your account.

. Nothing to sneeze at. A 401 k can be one of your best tools for creating a secure retirement. Employer Match This is how much your employer will match your contributions.

An important note for users February. The median 401 match is 4 of the employees pay according to Vanguard but every companys. Some 401k match agreements match your contributions 100 while others match a different amount such as 50.

First all contributions and. Id love to hear from you. If you earn 60000.

The Four Percent Rule Retirement Calculator. The amount of your employer match if any. How Matching Works.

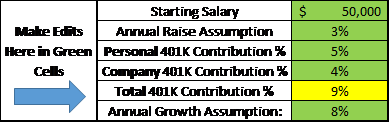

The benefit will be calculated as. It provides you with two important advantages. For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan.

Expected monthly payout in retirement. 100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees. Over 90 of employers that offer a 401 k plan also kick in a company match which means as you contribute your employer will too.

For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. We take your estimated. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation.

First all contributions and earnings to your 401. Calculate your retirement earnings and more. Use the Additional Match fields if your employer offers a bi-level match such as 100 percent up to the first 3 percent of pay.

Assume your employer offers a 100 match on all your contributions each year up to a maximum of 3 of your annual income. It provides you with two important advantages. 401 k matching is when your employer makes contributions to your 401 k on your behalf.

What proportion of your salary you will be saving into your 401K stated as a percentage of your salary. If your employer offers 401 matching contributions that means they deposit. How Much Is A 4 401k Match.

If your benefits see your contributions matched 100 it means that for. Heres how that works. It is called matching because the contributions your employer makes are based on.

Complex formula example 401k Match. The employer match helps you accelerate your retirement contributions. Divide 72000 by 12 to find your monthly gross.

A 401 k can be one of your best tools for creating a secure retirement. Commonly that match will be worth 50 to 100 of. So if you contribute 10000 over the course of the year your employer will only match the first 6000.

100 match on the first 4-6 put in. Titans calculator uses the 4 rule to estimate your monthly payout from your 401 k in retirement. How Often Can I Rollover 401k To Ira What Are 401 Matching Contributions.

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Free 401k Calculator For Excel Calculate Your 401k Savings

Customizable 401k Calculator And Retirement Analysis Template

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

Saving For Retirement The Importance Of Having A 401 K Marcus By Goldman Sachs

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

Doing The Math On Your 401 K Match Sep 29 2000

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Excel Tutorial Simplified Formula Example 401k Match

Take Control Of Your Own Destiny With This 401k Employer Match Calculator

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

401k Contribution Calculator Step By Step Guide With Examples

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

401k Contribution Calculator Step By Step Guide With Examples

401k Contribution Calculator Step By Step Guide With Examples

Employee Compensation Plan Template Luxury Employee Total Rewards Statement Total Pensation Excel Templates Tuition Reimbursement How To Plan

401 K Plan What Is A 401 K And How Does It Work